PR scramble for Reliant convergence

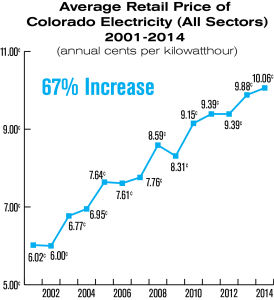

An advertising bad dream is going to deteriorate for Reliant Energy Plans , and company chiefs and the advertising workforce have been getting out and about in Houston media to reframe things. The organization has experienced harsh criticism from certain customers for proposing to burn through $300 million for naming privileges to the new football arena simultaneously its electric utility division, HL&P, has requested an expansion in power rates. It’s the below-average climb HL&P has mentioned for the current year for an all-out increment of 22%.

What’s more, on Wednesday, Reliant Energy will declare its second from last quarter profit, which is supposed to be $1.36 per share, up 37% from last year’s second from last quarter and an astounding 79 percent from the current year’s subsequent quarter. Yet, the rate climbs don’t have anything to do with the income or the field arrangement or the other way around, express authorities of Reliant HL&P and Reliant Energy – – which are going to become independent organizations. It’s a sad intermingling of irrelevant occasions which organization authorities anticipated and stressed over, they say. Be that as it may, the field bargain was viewed as a “once in a blue moon chance” for recently shaped Reliant Resources.

Janee Briesemeister, the chief of Consumers Union, agrees.

- The rate climbs have nothing to do with burning through cash on the field naming or their profit being up. They (HL&P) need to legitimize to the PUC (Public Utilities Commission) fuel costs in the commercial center are higher. However long they are managed, they can request that PUC let them give those greater expenses to buyers by raising their rates.

- Anything rates HL&P charges, the utility is precluded by regulation from creating again on the fuel it purchases to produce power, says Tom Standish, leader of Reliant HL&P. Under the directed framework that is slowing down and will leave presence on January 1, 2002, utilities have been permitted to recuperate their fuel costs and to demand rate changes two times per year.

- Utilities have needed to attempt to anticipate what the cost of fuel – – gaseous petrol for this situation – – would be from now on. Also, scarcely any individuals anticipated gaseous petrol would take off to the record costs at which it is presently selling.

- Whenever HL&P requested the top-notch climb recently, the utility was at that point $500 million “uncollected”- significance its power billings had gotten considerably less than the utility had paid for fuel by then, says Schaffer. The utility likewise realized it would keep on being under collected during the blistering late spring months and that its top-notch climb of 11% wouldn’t be sufficient.

- HL&P represents just a single quarter to 33% of Reliant’s incomes, says Standish, and the utility’s income development has been just a negligible portion of the 25 to 30 percent development in the parent organization’s incomes.

Isolating reliant energy

Dependent Energy is currently isolating Reliant HL&P from the remainder of the organization, which will become Reliant Resources, a free public corporation whose organizations will be unregulated. It will be a retail merchant of power, among different organizations, and the organization desires to profit from the arena naming arrangement similar to what Enron and Compaq have done.

Dependent HL&P will be totally a transmitter and merchant of power and thusly, will stay managed. Customers will never again manage HL&P. In any case, their wallets will, in any case, be impacted by the arrangements that HL&P and the state’s different utilities are now haggling with the PUC.

The issue that Consumer’s Union and others are observing intently at this moment, says Briesemeister, is the dollar sums that HL&P and other Texas utilities are attempting to give to clients as “abandoned” costs and as expenses of dispersion and transmission under the liberation conspire.